Information from Anthem for care providers about COVID-19 (updated April 6, 2021)

Please note that the following information applies to Anthem’s Commercial health plans. Please review the Medicare and Medicaid specific sites noted below for details about these plans.

Anthem Blue Cross and Blue Shield is a DSNP plan with a Medicare contract and a contract with the state Medicaid program. Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal. Anthem Blue Cross and Blue Shield is the trade name of: In Colorado: Rocky Mountain Hospital and Medical Service, Inc. HMO products underwritten. Anthem Blue Cross and Blue Shield is the trade name of: In Colorado: Rocky Mountain Hospital and Medical Service, Inc. HMO products underwritten by HMO Colorado, Inc. In Connecticut: Anthem Health Plans, Inc. In Georgia: Blue Cross Blue Shield Healthcare Plan of Georgia, Inc. In Indiana: Anthem Insurance Companies, Inc.

Commercial: Provider News Home

Medicare: Medicare Advantage Provider News Archives

Information from Anthem for Care Providers about COVID-19

Anthem is closely monitoring COVID-19 developments and what it means for our customers and our healthcare provider partners. Our clinical team is actively monitoring external queries and reports from the Centers for Disease Control and Prevention (CDC) to help us determine what action is necessary on our part.

To help address care providers’ questions, Anthem has developed the following updates and frequently asked questions.

Contents:

Update Summary

Frequently Asked Questions:

- Anthem’s actions

- COVID-19 testing

- COVID-19 vaccines

- Virtual, telehealth and telephonic care

- Coding, billing, and claims

- Other

Update Summary

COVID-19 testing and visits associated with COVID-19 testing

Anthem’s affiliated health plans will waive cost shares for our fully-insured employer, individual, Medicare and Medicaid plan members—inclusive of copays, coinsurance and deductibles—for COVID-19 test and visits and services during the visit associated with the COVID-19 test, including telehealth visits. Anthem looks for the CS modifier to identify visits and services leading to COVID-19 testing. This modifier should be used for evaluation and testing services in any place of service including a physician’s office, urgent care, ER or even drive-thru testing once available. While a test sample cannot be obtained through a telehealth visit, the telehealth provider can help members get to a provider who can do so. The waivers apply to members who have individual, employer-sponsored, Medicare and Medicaid plans.

Telehealth (video + audio)

For COVID-19 treatments via telehealth visits, Anthem’s affiliated health plans will cover telehealth and telephonic-only visits from in-network providers and will waive cost shares through January 31, 2021.

For telehealth services not related to the treatment of COVID-19 from Anthem’s telehealth provider, LiveHealth Online, cost sharing will be waived from March 17, 2020 through May 31, 2021, for our fully-insured employer, individual, and where permissible, Medicaid plans. Medicare Advantage members pay no member cost share for LiveHealth Online, regardless of national emergency.

From March 17, 2020, through September 30, 2020, Anthem’s affiliated health plans waived member cost shares for telehealth visits for services not related to the treatment of COVID-19 from in-network providers, including visits for mental health or substance use disorders, for our fully-insured employer plans, and individual plans.

For out-of-network providers, Anthem waived cost shares from March 17, 2020, through June 14, 2020. Cost sharing will be waived for members using Anthem’s authorized telemedicine service, LiveHealth Online, as well as care received from other providers delivering virtual care through internet video + audio services. We encourage our self-funded customers to participate, and these plans will have an opportunity to opt in.

Telephonic-only care

Effective from March 19, 2020, through May 31, 2021, Anthem’s affiliated health plans will cover telephonic-only visits with in-network providers. Out-of-network coverage will be provided where required by law. This includes covered visits for mental health or substance use disorders and medical services, for our fully-insured employer plans, individual plans, Medicare plans and Medicaid plans, where permissible. Cost shares will be waived for in-network providers only. We encourage our self-funded customers to participate, and these plans will have an opportunity to opt in.

Prescription coverage

Anthem’s affiliated health plans are also providing coverage for members to have an extra 30-day supply of medication on hand, and we are encouraging that when member plans allow, that members switch from 30-day home delivery to 90-day home delivery.

Frequently Asked Questions

Anthem’s actions

What is Anthem doing to prepare?

Anthem’s affiliated health plans are committed to help provide increased access to care, while eliminating costs and help alleviate the added stress on individuals, families and the nation’s healthcare system.

These actions are intended to support the protective measures taken across the country to help prevent the spread of COVID-19 and are central to the commitment of Anthem’s affiliated health plans to remove barriers for our members and support communities through this unprecedented time.

Anthem’s affiliated health plans are committed to help our members gain timely access to care and services in a way that places the least burden on the healthcare system. Our actions should reduce barriers to seeing a physician, getting tested and maintaining adherence to medications for long-term health issues.

Anthem is waiving:

- cost sharing for the treatment of COVID-19 from April 1, 2020, through January 31, 2021, for members of our fully-insured employer, individual, Medicare Advantage and Medicaid plans. We encourage our self-funded customers to participate, and these plans will have an opportunity to opt in.

- cost sharing for COVID-19 diagnostic tests as deemed medically necessary by a healthcare clinician who has made an assessment of a patient, including serology or antibody tests, for members of our employer-sponsored, individual, Medicare and Medicaid plans. Cost share waiver extends to the end of the public health emergency.

- cost sharing for visits and services during the visit to get the COVID-19 diagnostic test, beginning March 18, 2020, for members of our employer-sponsored, individual, Medicare and Medicaid plans. Cost share waiver extends to the end of the public health emergency.

- cost sharing for telehealth in-network visits for COVID-19 treatment from March 17, 2020, through January 31, 2021, including visits for behavioral health, for our fully-insured employer, individual plans, and where permissible, Medicaid. Medicare Advantage and Medicare GRS plans are waived through February 28, 2021.

- cost sharing for telehealth services not related to the treatment of COVID-19 from Anthem's telehealth provider, LiveHealth Online, from March 17, 2020, through May 31, 2021, for our fully-insured employer, individual, and where permissible, Medicaid plans. Medicare Advantage members pay no member cost share for LiveHealth Online, regardless of national emergency.

- cost sharing for telephonic-only in-network visits from March 19, 2020, through May 31, 2021, for fully-insured employer-sponsored, individual, Medicare and Medicaid plans. We encourage our self-funded customers to participate, and these plans will have an opportunity to opt in.

- cost sharing for U. S. Preventive Services Task Force (USPSTF) or CDC approved vaccines as they become available.

The cost sharing waiver includes copays, coinsurance, and deductibles.

For additional services, members will pay any cost shares their plan requires, unless otherwise determined by state law or regulation. Members can call the number on the back of their identification card to confirm coverage. Providers should continue to verify eligibility and benefits for all members prior to rendering services.

How is Anthem monitoring COVID-19?

Anthem is monitoring COVID-19 developments and what they mean for our associates and those we serve. We are fielding questions about the outbreak from our customers, members, providers and associates. Additionally, our clinical team is actively monitoring external queries and reports from the Centers for Disease Control and Prevention to help us determine what, if any, action is necessary on our part to further support our stakeholders.

Anthem has a business continuity plan for serious communicable disease outbreaks, inclusive of pandemics, and will be ready to deploy the plan if necessary.

Anthem’s enterprise wide business continuity program includes recovery strategies for critical processes and supporting resources, automated 24/7 situational awareness monitoring for our footprint and critical support points, and Anthem’s Virtual Command Center for Emergency Management command, control and communication.

In addition, Anthem has established a team of experts to monitor, assess and help facilitate timely mitigation and response where we have influence as appropriate for the evolving novel coronavirus threat.

In case of mass pandemic, how can you ensure that your contracted providers can still provide services?

Anthem is committed to working with and supporting our contracted providers. Our benefits already state that if members do not have appropriate access to network physician that we will authorize coverage for out-of-network physicians as medically necessary.

In addition, Anthem’s telehealth provider, LiveHealth Online, is another safe and effective way for members to see a physician to receive health guidance related to COVID-19 from home via a mobile device or computer with a webcam.

COVID-19 testing

When member cost sharing has been waived (where permissible) by Anthem as outlined in this FAQ for COVID-19 testing and visits associated with COVID-19 testing, telehealth (video + audio) services, and in-network telephonic-only services, how does that impact provider reimbursement?

Anthem will process the claim as if there is no member cost sharing, as it does, for example, with preventative health services.

How is Anthem reimbursing participating hospitals that perform COVID-19 diagnostic testing in an emergency room or inpatient setting?

Reimbursement for COVID-19 testing performed in a participating hospital emergency room or inpatient setting is based on existing contractual rates inclusive of member cost share amounts waived by Anthem. As we announced on March 6, 2020, Anthem will waive cost shares for members of our fully insured employer-sponsored, individual, Medicare, Medicaid and self-funded plan members—inclusive of copays, coinsurance and deductibles—for COVID-19 test and visits to get the COVID-19 test.

How is Anthem reimbursing participating hospitals that are performing COVID-19 diagnostic testing in a drive- thru testing setting?

Based on standard AMA and HCPCS coding guidelines, for participating hospitals with a lab fee schedule, Anthem will recognize the codes 87635 and U0002, and will reimburse drive-thru COVID-19 tests according to the lab fee schedule inclusive of member cost-share amounts waived by Anthem. Participating hospitals without lab fee schedules will follow the same lab testing reimbursement as defined in their facility agreement with Anthem inclusive of member cost share amounts waived by Anthem. As we announced on March 6, 2020, Anthem will waive cost shares for members of our fully-insured employer-sponsored, individual, Medicare, Medicaid and self-funded plan members—inclusive of copays, coinsurance and deductibles—for COVID-19 test and visits to get the COVID-19 test.

Does Anthem require a prior authorization on the focused test used to diagnose COVID-19?

No, prior authorization is not required for diagnostic services related to COVID-19 testing.

Does Anthem require use of a contracted provider for the COVID-19 lab test in order for waiver of the member’s cost share to apply?

Anthem will waive member cost shares for COVID-19 lab tests performed by participating and non-participating providers. This is applicable for our employer-sponsored, individual, Medicare and Medicaid plan members.

What codes would be appropriate for COVID-19 lab testing?

Anthem is encouraging providers to bill with codes U0001, U0002, U0003, U0004, 86328, 86769, or 87635 based on the test provided.

COVID-19 vaccines

How is Anthem reimbursing U.S. Food and Drug Administration (FDA)-approved COVID-19 vaccines?

The cost of COVID-19 FDA-approved vaccines will initially be paid for by the government.

For members of our fully-insured employer and individual plans, as well as self-funded plans, Anthem will reimburse for the administration of COVID-19 FDA-approved vaccines at a reasonable prevailing rate. Anthem will cover the administration of COVID-19 vaccines with no cost share for in- and out-of-network providers, during the national public health emergency, and providers are not permitted under the federal mandate to balance-bill members.

For members of Medicare Advantage plans, CMS issued guidance (https://www.cms.gov/files/document/COVID-19-toolkit-issuers-MA-plans.pdf) that the COVID-19 vaccine administration should be billed by providers to the CMS Medicare Administrative Contractor (MAC) using product-specific codes for each vaccine approved. This will ensure that Medicare Advantage members will not have cost sharing for the administration of the vaccine.

For members of Medicaid plans, Medicaid state-specific rate and other state regulations may apply.

What CPT/HCPCS codes would be appropriate to consider for the administration of a COVID-19 vaccines?

CMS has provided coding guidelines related to COVID-19 vaccines: https://www.cms.gov/medicare/medicare-part-b-drug-average-sales-price/covid-19-vaccines-and-monoclonal-antibodies

Virtual, telehealth and telephonic care

Will Anthem cover telephonic-only services in addition to telehealth via video + audio?

Anthem does not cover telephonic-only services today (with limited state exceptions) but we are providing this coverage effective from March 19, 2020, through May 31, 2021, to reflect the concerns we have heard from providers about the need to support continuity of care for plan members during extended periods of social distancing. Anthem will cover telephonic-only medical and behavioral health services from in-network providers and out-of-network providers when required by state law. Anthem will waive associated cost shares for in-network providers only except where a broader waiver is required by law. We encourage our self-funded customers to participate, and these plans will have an opportunity to opt in.

What member cost-shares will be waived by Anthem’s affiliated health plans for virtual care through internet video + audio or telephonic-only care?

For COVID-19 treatments via telehealth visits, Anthem’s affiliated health plans will cover telehealth and telephonic-only visits from in-network providers and will waive cost shares through January 31, 2021.

For telehealth services not related to the treatment of COVID-19 from Anthem’s telehealth provider, LiveHealth Online, cost sharing will be waived from March 17, 2020, through May 31, 2021, for our fully-insured employer, individual, and where permissible, Medicaid plans. Medicare Advantage members pay no member cost share for LiveHealth Online, regardless of national emergency.

From March 17, 2020 to September 30, 2020, Anthem’s affiliated health plans waived member cost share for telehealth (video + audio) in-network provider visits for services not related to the treatment of COVID-19, including visits for behavioral health, for our fully-insured employer plans and individual plans. For out-of-network providers, Anthem waived cost shares from March 17, 2020, through June 14, 2020. Cost sharing will be waived for members using Anthem’s telemedicine service, LiveHealth Online, as well as care received from other providers delivering virtual care through internet video + audio services. We encourage our self-funded customers to participate, and these plans will have an opportunity to opt in.

Effective from March 19, 2020, through May 31, 2021, Anthem will cover telephonic-only medical and behavioral health services from in-network providers and out-of-network providers when required by state law. Anthem will waive associated cost shares for in-network providers only except where a broader waiver is required by law. We encourage our self-funded customers to participate, and these plans will have an opportunity to opt in.

Is Anthem’s vendor, LiveHealth Online, prepared for the number of visits that will increase to telehealth?

As there is a heightened awareness of COVID-19 and more cases are being diagnosed in the United States, LiveHealth Online is increasing physician availability and stands ready to have physicians available to see the increase in patients, while maintaining reasonable wait times.

What codes would be appropriate to consider for a telehealth visit?

For telehealth services rendered by a professional provider, report the CPT/HCPCS code with Place of Service “02” and also append either modifier 95 or GT.

For telehealth services rendered by a facility provider, report the CPT/HCPCS code with the applicable revenue code as would normally be done for an in-person visit, and also append either modifier 95 or GT.

What codes would be appropriate to consider for telehealth (audio and video) for physical, occupational, and speech therapies?

Telehealth visits for the following physical, occupational and speech therapies for visits coded with Place of Service (POS) “02” and modifier 95 or GT would be appropriate for our fully-insured employer, individual, Medicare Advantage plans and Medicaid plans, where permissible:

- Physical therapy (PT) evaluation codes 97161, 97162, 97163 and 97164

- Occupational (OT) therapy evaluation codes 97165, 97166, 97167 and 97168

- PT/OT treatment codes 97110, 97112, 97530 and 97535

- Speech therapy (ST) evaluation codes 92521, 92522, 92523 and 92524

- ST treatment codes 92507, 92526, 92606 and 92609

PT/OT codes that require equipment and/or direct physical hands-on interaction and therefore are not appropriate via telehealth include: 97010-97028, 97032-97039, 97113-97124, 97139-97150, 97533 and 97537-97546.

What codes would be appropriate to consider for a telephonic-only visit with a patient who wants to receive health guidance during the COVID-19 crisis?

Submit with the correct time-based CPT code (99441, 99442, 99443, 98966, 98967, 98968) and the place of service code that depicts where the provider’s telephonic-only services occurred.

What is the best way that providers can get information to Anthem’s members on Anthem’s alternative virtual care offerings?

Anthem.com and Anthem’s COVID-19 site (https://www.anthem.com/blog/member-news/how-to-protect/) are great resources for members with questions and are being updated regularly.

Anthem members have access to telehealth 24/7 through LiveHealth Online. Members can access LiveHealth Online at https://livehealthonline.com/ or download the LiveHealth Online app from the App Store or Google Play.

Anthem members also can call the Anthem 24/7 NurseLine at the number listed on their Anthem ID card to speak with a registered nurse about health questions.

Coding, billing, and claims

Does Anthem have recommendations for reporting, testing and specimen collection?

The Centers for Disease Control and Prevention (CDC) updates these recommendations frequently as the situation and testing capabilities evolve. See the latest information from the CDC: https://www.cdc.gov/coronavirus/2019-nCoV/hcp/clinical-criteria.html

What diagnosis codes would be appropriate to consider for a patient with known or suspected COVID-19 for services where a member’s cost shares are waived?

The CDC has provided coding guidelines related to COVID-19: https://www.cdc.gov/nchs/data/icd/COVID-19-guidelines-final.pdf

What modifier is appropriate to waive member cost sharing for COVID-19 testing and visits related to testing?

CMS has provided the Medicare guideline to use the CS modifier: https://www.cms.gov/outreach-and-educationoutreachffsprovpartprogprovider-partnership-email-archive/2020-04-10-mlnc-se. Anthem also looks for the CS modifier to identify claims related to evaluation for COVID-19 testing. This modifier should be used for COVID-19 evaluation and testing services in any place of service.

Does Anthem expect any slowdown with claim adjudication because of COVID-19?

We are not seeing any impacts to claims payment processing at this time.

Should providers who are establishing temporary locations to provide healthcare services during the COVID-19 emergency notify Anthem of the new temporary address(es)?

Providers do not need to notify Anthem of temporary addresses for providing healthcare services during the COVID-19 emergency. Providers should continue to submit claims specifying the services provided using the provider’s primary service address along with current tax ID number.

Will Anthem allow Roster Billing for the COVID-19 vaccine?

Providers who currently submit electronic claims are encouraged to do so. The electronic process is the quickest way to get the claims to Anthem.

Yes, Anthem will accept Roster Billing from providers and state agencies that are offering mass vaccinations for their local communities. Providers may submit the COVID-19 Vaccination Roster Billing Form to Availity at https://www.availity.com/ by signing in and submitting the form electronically to the Anthem health plan.

How can a provider submit Anthem’s Roster Billing claim form?

In addition to Availity.com, providers and state agencies who wish to submit Roster Billing claims can submit paper forms:

- Paper submission form (editable pdf)

- Obtain form from Anthem.com https://www.anthem.com/docs/public/inline/COV19_BillRoster_ABCBS.pdf and upload to Availity at the entry point to web form

Or

- Obtain form from Anthem.com https://www.anthem.com/docs/public/inline/COV19_BillRoster_ABCBS.pdf and mail to:

Anthem Blue Cross and Blue Shield

PO Box 27401

Richmond VA 23261

Is there a specific diagnosis code Anthem would look for on the COVID-19 Vaccination Roster Billing Form?

No. However, to assist providers our COVID-19 Vaccination Roster Billing Form provides a default Z23 diagnosis code.

Other

Do the guidelines contained in this FAQ apply to members enrolled in the Anthem affiliated health plans in states living in another BCBS Plan’s service area?

Anthem’s guidelines apply to Anthem’s affiliated health plan’s membership (members with Anthem ID cards) wherever they reside, except where prohibited by law or local emergency guidelines. Each BCBS Plan may have different guidelines that apply to members of other Blue plans. Providers should continue to verify an individual’s eligibility and benefits prior to rendering services.

Do these guidelines apply to members enrolled in the Blue Cross and Blue Shield Service Benefit Plan commonly referred to as the Federal Employee Program (FEP®)?

Where permissible, these guidelines apply to FEP members. For the most up-to-date information about the changes FEP is making, go to https://www.fepblue.org/coronavirus.

Are you aware of any limitations in coverage for treatment of an illness/virus/disease that is part of a pandemic?

Our standard health plan contracts do not have exclusions or limitations on coverage for services for the treatment of illnesses that result from a pandemic.

If you have questions, please contact your local Anthem representative.

Please note that the above information applies to Anthem’s Commercial health plans. Please review the Medicare and Medicaid specific sites noted below for details about these plans.

Commercial: Provider News Home

Medicare: Medicare Advantage Provider News Archives

288-0421-WP-GA

COVID-19 Information

Jump to:

Anthem MediBlue Access (PPO) H8552-029 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Anthem Blue Cross Life and Health Insurance Co available to residents in California. This plan includes additional Medicare prescription drug (Part-D) coverage. The Anthem MediBlue Access (PPO) has a monthly premium of $30.00 and has an in-network Maximum Out-of-Pocket limit of $6,700 (MOOP). This means that if you get sick or need a high cost procedure the co-pays are capped once you pay $6,700 out of pocket. This can be a extremely nice safety net.

Anthem MediBlue Access (PPO) is a Local PPO. A preferred provider organization (PPO) is a Medicare plan that has created contracts with a network of 'preferred' providers for you to choose from at reduced rates. You do not need to select a primary care physician and you do not need referrals to see other providers in the network. Offering you a little more flexibility overall. You can get medical attention from a provider outside of the network but you will have to pay the difference between the out-of-network bill and the PPOs discounted rate.

Anthem Blue Cross Life and Health Insurance Co works with Medicare to provide significant coverage beyond Part A and Part B benefits. If you decide to sign up for Anthem MediBlue Access (PPO) you still retain Original Medicare. But you will get additional Part A (Hospital Insurance) and Part B (Medical Insurance) coverage from Anthem Blue Cross Life and Health Insurance Co and not Original Medicare. With Medicare Advantage Plans you are always covered for urgently needed and emergency care. Plus you receive all of the benefits of Original Medicare from Anthem Blue Cross Life and Health Insurance Co except hospice care. Original Medicare still provides you with hospice care even if you sign up for a Medicare Advantage Plan.

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Fri 8am-9pm EST

Sat 9am-9pm EST

2021 Anthem Blue Cross Life and Health Insurance Co Medicare Advantage Plan Costs

| Name: | |

|---|---|

| Plan ID: | H8552-029 |

| Provider: | Anthem Blue Cross Life and Health Insurance Co |

| Year: | 2021 |

| Type: | Local PPO |

| Monthly Premium C+D: | $30.00 |

| Part C Premium: | $0 |

| MOOP: | $6,700 |

| Part D (Drug) Premium: | $30.00 |

| Part D Supplemental Premium | $0 |

| Total Part D Premium: | $30.00 |

| Drug Deductible: | $370.0 |

| Tiers with No Deductible: | 1 |

| Gap Coverage: | No |

| Benchmark: | not below the regional benchmark |

| Type of Medicare Health: | Enhanced Alternative |

| Drug Benefit Type: | Enhanced |

| Similar Plan: | H8552-020 |

Anthem MediBlue Access (PPO) Part-C Premium

Anthem Blue Cross Life and Health Insurance Co plan charges a $0 Part-C premium. The Part C premium covers Medicare medical, hospital benefits and supplemental benefits if offered. You generally are also responsible for paying the Part B premium.

H8552-029 Part-D Deductible and Premium

Anthem MediBlue Access (PPO) has a monthly drug premium of $30.00 and a $370.0 drug deductible. This Anthem Blue Cross Life and Health Insurance Co plan offers a $30.00 Part D Basic Premium that is not below the regional benchmark. This covers the basic prescription benefit only and does not cover enhanced drug benefits such as medical benefits or hospital benefits. The Part D Supplemental Premium is $0 this Premium covers any enhanced plan benefits offered by Anthem Blue Cross Life and Health Insurance Co above and beyond the standard PDP benefits. This can include additional coverage in the gap, lower co-payments and coverage of non-Part D drugs. The Part D Total Premium is $30.00. The Part D Total Premium is the addition of the supplemental and basic premiums for some plans this amount can be lower due to negative basic or supplemental premiums.

Anthem Blue Cross Life and Health Insurance Co Gap Coverage

In 2021 once you and your plan provider have spent $4130 on covered drugs. (combined amount plus your deductible) You will be in the coverage gap. (AKA 'donut hole') You will be required to pay 25% for prescription drugs unless your plan offers additional coverage. This Anthem Blue Cross Life and Health Insurance Co plan does not offer additional coverage through the gap.

Premium Assistance

The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage. Depending on your income level you may be eligible for full 75%, 50%, 25% premium assistance. The Anthem MediBlue Access (PPO) medicare insurance offers a $0 premium obligation if you receive a full low-income subsidy (LIS) assistance. And the payment is $7.50 for 75% low income subsidy $15.00 for 50% and $22.50 for 25%.

| Full LIS Premium: | $0 |

|---|---|

| 75% LIS Premium: | $7.50 |

| 50% LIS Premium: | $15.00 |

| 25% LIS Premium: | $22.50 |

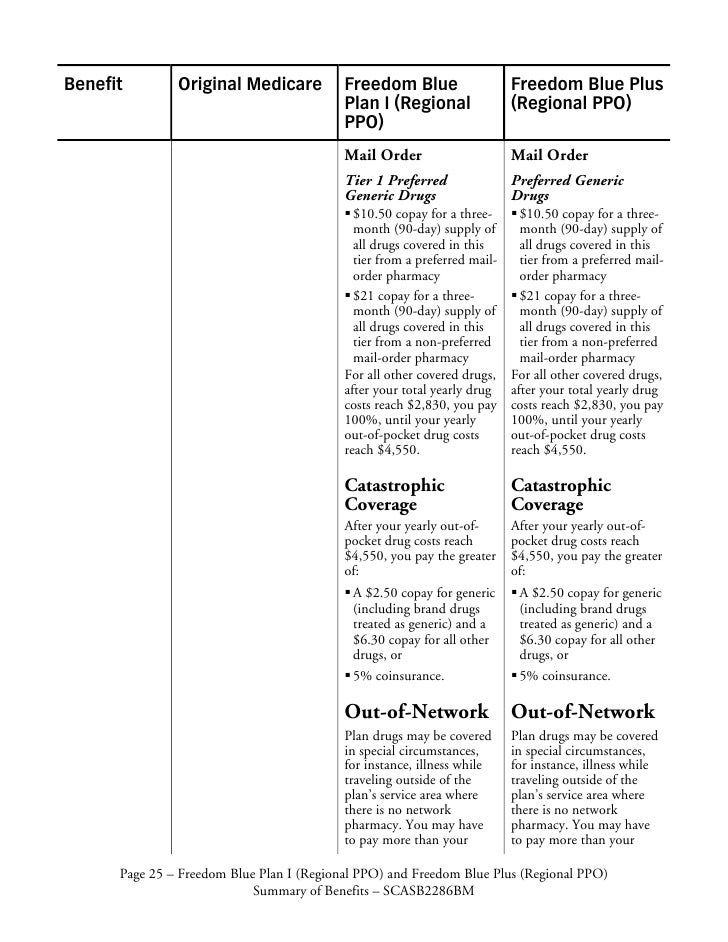

H8552-029 Formulary or Drug Coverage

Anthem MediBlue Access (PPO) formulary is divided into tiers or levels of coverage based on usage and according to the medication costs. Each tier will have a defined copay that you must pay to receive the drug. Drugs in lower tiers will usually cost less than those in higher tiers.By reviewing different Medicare Drug formularies, you can pick a Medicare Advantage plan that covers your medications. Additionally, you can choose a plan that has your drugs listed at a lower price.

2021 Anthem MediBlue Access (PPO) Summary of Benefits

Additional Benefits

| No |

|---|

Comprehensive Dental

| Diagnostic services | Not covered |

|---|---|

| Endodontics | Not covered |

| Extractions | Not covered |

| Non-routine services | Not covered |

| Periodontics | Not covered |

| Prosthodontics, other oral/maxillofacial surgery, other services | Not covered |

| Restorative services | Not covered |

Deductible

| $590 annual deductible |

|---|

Diagnostic Tests and Procedures

| Diagnostic radiology services (e.g., MRI) | $75 copay |

|---|---|

| Diagnostic radiology services (e.g., MRI) | 40% coinsurance (Out-of-Network) |

| Diagnostic tests and procedures | $0-75 copay |

| Diagnostic tests and procedures | 40% coinsurance (Out-of-Network) |

| Lab services | 40% coinsurance (Out-of-Network) |

| Lab services | $0-5 copay |

| Outpatient x-rays | $25 copay |

| Outpatient x-rays | 40% coinsurance (Out-of-Network) |

Doctor Visits

| Primary | $10 copay per visit |

|---|---|

| Primary | $30 copay per visit (Out-of-Network) |

| Specialist | $35 copay per visit |

| Specialist | $50 copay per visit (Out-of-Network) |

Emergency care/Urgent Care

| Emergency | $90 copay per visit (always covered) |

|---|---|

| Urgent care | $30 copay per visit (always covered) |

Foot Care (podiatry services)

| Foot exams and treatment | $35 copay |

|---|---|

| Foot exams and treatment | $50 copay (Out-of-Network) |

| Routine foot care | Not covered |

Ground Ambulance

| $325 copay (Out-of-Network) |

|---|

| $325 copay |

Hearing

| Fitting/evaluation | 20% coinsurance (Out-of-Network) |

|---|---|

| Fitting/evaluation | $0 copay |

| Hearing aids | $0 copay |

| Hearing aids | $0 copay (Out-of-Network) |

| Hearing exam | 40% coinsurance (Out-of-Network) |

| Hearing exam | $35 copay |

Inpatient Hospital Coverage

Anthem Blue Cross Copay Acupuncture

| $175 per day for days 1 through 7 $0 per day for days 8 through 90 |

|---|

| 40% per stay (Out-of-Network) |

Medical Equipment/Supplies

| Diabetes supplies | 40% coinsurance per item (Out-of-Network) |

|---|---|

| Diabetes supplies | $0 copay |

| Durable medical equipment (e.g., wheelchairs, oxygen) | 40% coinsurance per item (Out-of-Network) |

| Durable medical equipment (e.g., wheelchairs, oxygen) | 0-20% coinsurance per item |

| Prosthetics (e.g., braces, artificial limbs) | 20% coinsurance per item |

| Prosthetics (e.g., braces, artificial limbs) | 40% coinsurance per item (Out-of-Network) |

Medicare Part B Drugs

| Chemotherapy | 40% coinsurance (Out-of-Network) |

|---|---|

| Chemotherapy | 20% coinsurance |

| Other Part B drugs | 40% coinsurance (Out-of-Network) |

| Other Part B drugs | 20% coinsurance |

Mental Health Services

| Inpatient hospital - psychiatric | $175 per day for days 1 through 7 $0 per day for days 8 through 90 |

|---|---|

| Inpatient hospital - psychiatric | 40% per stay (Out-of-Network) |

| Outpatient group therapy visit | $20 copay |

| Outpatient group therapy visit | $50 copay (Out-of-Network) |

| Outpatient group therapy visit with a psychiatrist | $50 copay (Out-of-Network) |

| Outpatient group therapy visit with a psychiatrist | $20 copay |

| Outpatient individual therapy visit | $50 copay (Out-of-Network) |

| Outpatient individual therapy visit | $20 copay |

| Outpatient individual therapy visit with a psychiatrist | $20 copay |

| Outpatient individual therapy visit with a psychiatrist | $50 copay (Out-of-Network) |

MOOP

| $10,000 In and Out-of-network $6,700 In-network |

|---|

Option

| No |

|---|

Optional supplemental benefits

| Yes |

|---|

Outpatient Hospital Coverage

| $0-175 copay per visit |

|---|

| 40% coinsurance per visit (Out-of-Network) |

Package #1

| Deductible | |

|---|---|

| Monthly Premium | $23.00 |

Package #2

| Deductible | |

|---|---|

| Monthly Premium | $35.00 |

Package #3

| Deductible | |

|---|---|

| Monthly Premium | $58.00 |

Preventive Care

| $0 copay |

|---|

| 40% coinsurance (Out-of-Network) |

Preventive Dental

| Cleaning | $0 copay |

|---|---|

| Cleaning | 20% coinsurance (Out-of-Network) |

| Dental x-ray(s) | Not covered |

| Fluoride treatment | Not covered |

| Oral exam | $0 copay |

| Oral exam | 20% coinsurance (Out-of-Network) |

Rehabilitation Services

| Occupational therapy visit | $50 copay (Out-of-Network) |

|---|---|

| Occupational therapy visit | $25 copay |

| Physical therapy and speech and language therapy visit | $25 copay |

| Physical therapy and speech and language therapy visit | $50 copay (Out-of-Network) |

Skilled Nursing Facility

| $0 per day for days 1 through 20 $140 per day for days 21 through 100 |

|---|

| 40% per stay (Out-of-Network) |

Transportation

| Not covered |

|---|

Vision

| Contact lenses | $0 copay (Out-of-Network) |

|---|---|

| Contact lenses | $0 copay |

| Eyeglass frames | $0 copay |

| Eyeglass frames | $0 copay (Out-of-Network) |

| Eyeglass lenses | $0 copay (Out-of-Network) |

| Eyeglass lenses | $0 copay |

| Eyeglasses (frames and lenses) | $0 copay (Out-of-Network) |

| Eyeglasses (frames and lenses) | $0 copay |

| Other | Not covered |

| Routine eye exam | $0 copay (Out-of-Network) |

| Routine eye exam | $0 copay |

| Upgrades | Not covered |

Wellness Programs (e.g. fitness nursing hotline)

| Covered |

|---|

Reviews for Anthem MediBlue Access (PPO) H8552

| 2019 Overall Rating |

|---|

| Part C Summary Rating |

| Part D Summary Rating |

| Staying Healthy: Screenings, Tests, Vaccines |

| Managing Chronic (Long Term) Conditions |

| Member Experience with Health Plan |

| Complaints and Changes in Plans Performance |

| Health Plan Customer Service |

| Drug Plan Customer Service |

| Complaints and Changes in the Drug Plan |

| Member Experience with the Drug Plan |

| Drug Safety and Accuracy of Drug Pricing |

Staying Healthy, Screening, Testing, & Vaccines

Anthem Copay Waiver

| Total Preventative Rating |

|---|

| Breast Cancer Screening |

| Colorectal Cancer Screening |

| Annual Flu Vaccine |

| Improving Physical |

| Improving Mental Health |

| Monitoring Physical Activity |

| Adult BMI Assessment |

Managing Chronic And Long Term Care for Older Adults

| Total Rating |

|---|

| SNP Care Management |

| Medication Review |

| Functional Status Assessment |

| Pain Screening |

| Osteoporosis Management |

| Diabetes Care - Eye Exam |

| Diabetes Care - Kidney Disease |

| Diabetes Care - Blood Sugar |

| Rheumatoid Arthritis |

| Reducing Risk of Falling |

| Improving Bladder Control |

| Medication Reconciliation |

| Statin Therapy |

Member Experience with Health Plan

Anthem Bcbs Colorado

| Total Experience Rating |

|---|

| Getting Needed Care |

| Customer Service |

| Health Care Quality |

| Rating of Health Plan |

| Care Coordination |

Member Complaints and Changes in Anthem MediBlue Access (PPO) Plans Performance

| Total Rating |

|---|

| Complaints about Health Plan |

| Members Leaving the Plan |

| Health Plan Quality Improvement |

| Timely Decisions About Appeals |

Health Plan Customer Service Rating for Anthem MediBlue Access (PPO)

| Total Customer Service Rating |

|---|

| Reviewing Appeals Decisions |

| Call Center, TTY, Foreign Language |

Anthem MediBlue Access (PPO) Drug Plan Customer Service Ratings

| Total Rating |

|---|

| Call Center, TTY, Foreign Language |

| Appeals Auto |

| Appeals Upheld |

Ratings For Member Complaints and Changes in the Drug Plans Performance

| Total Rating |

|---|

| Complaints about the Drug Plan |

| Members Choosing to Leave the Plan |

| Drug Plan Quality Improvement |

Member Experience with the Drug Plan

| Total Rating |

|---|

| Rating of Drug Plan |

| Getting Needed Prescription Drugs |

Drug Safety and Accuracy of Drug Pricing

| Total Rating |

|---|

| MPF Price Accuracy |

| Drug Adherence for Diabetes Medications |

| Drug Adherence for Hypertension (RAS antagonists) |

| Drug Adherence for Cholesterol (Statins) |

| MTM Program Completion Rate for CMR |

| Statin with Diabetes |

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Sat 8am-11pm EST

Sun 9am-6pm EST

Coverage Area for Anthem MediBlue Access (PPO)

(Click county to compare all available Advantage plans)

| State: | California |

|---|---|

| County: | Butte,El Dorado,Napa,Shasta,Solano, Sonoma,Sutter,Tehama,Yuba, |

Anthem Blue Cross Urgent Care Copay

Go to topAnthem Bcbs Insurance

Source: CMS.

Data as of September 9, 2020.

Notes: Data are subject to change as contracts are finalized. For 2021, enhanced alternative may offer additional cost sharing reductions in the gap on a sub-set of the formulary drugs, beyond the standard Part D benefit.Includes 2021 approved contracts. Employer sponsored 800 series and plans under sanction are excluded.